A break through step in creating and promoting market place for financial products in India, has been taken by Reserve Bank of India by conceptualizing the idea of set up of exchange for online discounting of Trade receivables.

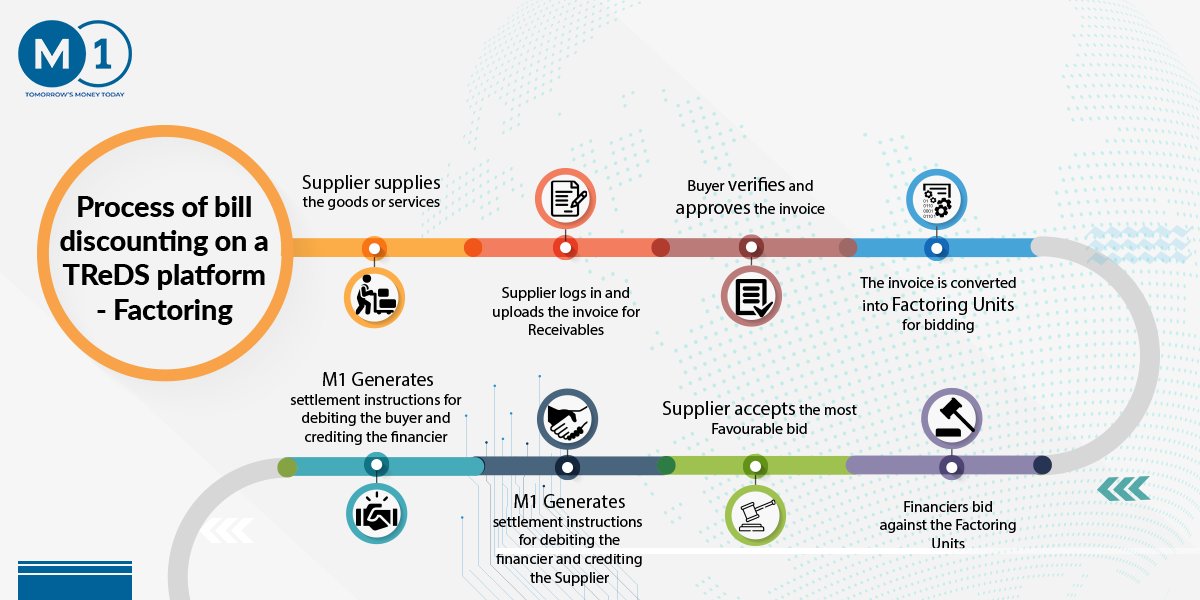

This is a bold and game changing initiative by RBI to bring the needful change in the market of receivables management for MSME sector. TReDS platform will serve as a central marketplace for e-Discounting of receivables to the participants, namely Purchasers (Corporate buyers), Suppliers (mainly the MSME players) and the Financiers (Banks, Financial Institutions, NBFCs). Financers will bid for the best rate of discount for the buyer approved invoices on TReDS portal. The Suppliers will choose the best bid and receive the payments instantaneously. Financiers will collect the payment from Purchasers on due date.

|

| Image Sources: Twitter |

Mynd Solutions, a key global Business Process Management (BPM) service provider, offering services in business process and technology management, has been appointed by RBI for implementing and managing the exchange namely TReDS. Mynd enables the solution of vendor management and payments process for many large corporates and this platform will enable to customize payments solutions. Private and new age banks have shown keen interest to support this initiative with Mynd.

Press Article References:

No comments:

Post a Comment